Effective November 21, 2022, we have enhanced the Managed Allocation Portfolio by adding an additional 6 bands. The expansion of more bands helps smooth the shift of assets while potentially decreasing investment risk.

This change means that as a beneficiary ages, Managed Allocation Portfolio assets in each account are moved from one age band to the next following the beneficiary’s birthday at ages 2, 4, 6, 8, 10, 12, 14, 15, 16, 17 and 18.

Managed Allocation Portfolio (Age Bands) effective November 21, 2022.

The Managed Allocation Portfolio seeks to match up the investment objective and level of risk to the investment horizon by taking into account the beneficiary’s current age and the number of years before the beneficiary turns 18 and is expected to enter college or training. Depending on the beneficiary’s age, allocations to this investment portfolio will be placed in one of 12 age bands, each of which has a different investment objective and investment strategy. The age bands for younger beneficiaries seek a favorable long-term return by investing primarily in mutual funds that invest primarily in equity securities, each of which has a high level of risk, but greater potential for returns than more conservative investments. As a beneficiary nears high school graduation age, the age bands allocate less to mutual funds that invest in equity securities and allocate more to mutual funds that invest in fixed-income and money market securities.

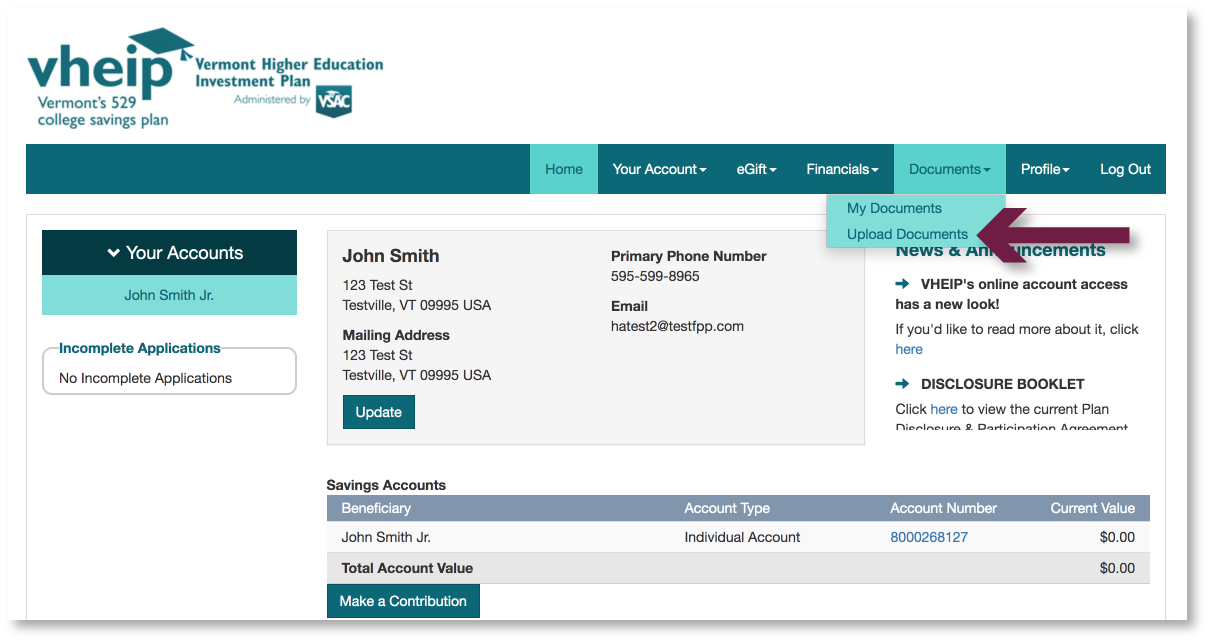

Allocations can be viewed and modified under the Financials tab.