New to VHEIP? Register Now!

How To’s

What do you want to do? Select from the list below for info.

Federal tax reform info: The Internal Revenue Code includes provisions related to 529 plan accounts. See the Disclosure Booklet for details. In 2022, Vermont tax law was updated to add two new allowable uses of funds withdrawn from a VT529 account without adverse impact on the Vermont income tax credit: (1) for apprenticeship programs registered and certified with the U.S. Secretary of Labor and (2) for repayment of up to $10,000 per the lifetime of a beneficiary in student loans for post-secondary education at an approved postsecondary education institution. (See the VHEIP tax credit information on the VT Tax website.) Vermont tax law currently does not treat a rollover to a Roth IRA or a withdrawal used for K through 12 education expenses as an allowable use. Please consult your tax advisor for how this may affect your personal Vermont tax situation.

-

Open an Account

It’s easy to open an account with VHEIP and it only takes $25 to get started! Go to the Open an Account page to learn more.

-

Give a Gift

Choose how you want to give a gift that lasts a lifetime! It’s one of the most important investments you can make in a child’s future.

With VHEIP, it’s easy to give.

- Gift Option 1: Open a NEW VHEIP account for a beneficiary.

- Gift Option 2: Contribute to an EXISTING VHEIP account.

- Gift Option 3: Invite friends & family to contribute directly to your VHEIP accounts if you are already an existing account owner.

- Gift Option 4: Purchase or redeem a Gift of College gift card.

Go to the Give a Gift page for details.

-

Purchase or Redeem a Gift of College Gift Card

VSAC, state administrator of the VHEIP 529 college savings program, is pleased to offer Gift of College gift cards in $50 amounts at Vermont locations of Kinney Drugs and Cumberland Farms stores. Specific stores locations are listed on the Gift of College website Buy-In-Store link.

Redeeming a Gift of College gift card? It’s easy!

-

- If you do not already have an existing 529 account, you’ll need to set up an account into which you can deposit your Gift of College funds. Click here to open an account with the Vermont 529 college savings plan.

- Already have a VHEIP 529 account? You’ll need to register at the Gift of College site to redeem your card. See the step-by-step instructions at vheip.org/redeem.

-

-

Make a Contribution or Set Up Automatic Contributions

Contribute as little as $25 as often as you like. The more you invest and the earlier you start, the more opportunity your money has to grow. What are the minimum and maximum contribution limits?

Choose how you’d like to contribute:

- Make a one-time contribution online at any time from a checking or savings account.

- Set up an automatic contribution plan from your checking or savings account to make recurring contributions to your VHEIP account(s):

- You choose an amount (as little as $25).

- You choose the schedule (monthly, quarterly, yearly, etc.).

Need to contribute, sign up for an automatic contribution plan, or make another change? Log in to your account at any time or see our Account Forms page.

-

Set Up Payroll Deduction

Payroll deductions make contributing to your VHEIP account seamless and easy. Every little bit helps! If your employer allows, you can contribute through your paycheck for as little as $15 per pay period.

Employee

- Make sure you already have a VHEIP account established and are the account owner on any account(s) that you would like to receive your payroll deduction contributions.

- Check to see if your employer can submit payroll deduction through Automated Clearing House (ACH).

- Log in to sign up for payroll deductions with VHEIP and tell us how you want your payroll deduction contributions to be allocated across all of your accounts.

- VHEIP will then provide instructions that you can give to your employer to start the payroll deduction contributions.

Employer

- Have the employee provide you with a copy of the payroll deduction instructions they have been given by VHEIP.

- Submit payroll deduction contributions to VHEIP via Automated Clearing House (ACH) for each employee as follows:

Code the Account Type

CheckingTransmit to Bank Routing

# (ABA) 104000016 (First National Bank of Omaha)Enter Account Number, a space, and the last 8 digits of the employees SSN/TIN

110487034_XXXXXXXXDownload the VHEIP Payroll Deduction Guidelines for additional information for employees and employers.

Need to sign up for payroll contributions or make another change? Log in to you account online at any time or see our Account Forms page.

-

Rollover/Transfer from Another College Savings Account

Already have a 529 college savings plan account with another state? Or a Coverdell ESA or UGMA/UTMA for a child? If you’re a Vermont taxpayer, moving those assets to a VHEIP account may provide you with additional benefits, such as the Vermont state income tax credit on the contributions portion of the rollover and on future contributions you make into your VHEIP account. To be eligible for the Vermont income tax credit, the rollover funds must remain in VHEIP for the remainder of the tax year.

Before doing a rollover from another account, consider the differences in features and costs, and any possible tax consequences. Make sure to read the VHEIP Disclosure Booklet.

Transferring from another state’s 529 college savings plan?

- While all 529 plans share the federal and state tax deferment on earnings and tax exemption on qualified withdrawals, only contributions into a VHEIP account are eligible for the Vermont state income tax credit.

- You are permitted to transfer funds from another 529 college savings plan to an account in VHEIP for the same beneficiary once within a 12-month period.

- To make a transfer into your existing VHEIP account, complete the Incoming Rollover Form and return it to us.

- If you don’t yet have an account established with VHEIP, open a new VHEIP account. You will still need to complete the form and return it to us, so we can initiate the transfer request with the financial institution holding your funds.

Transferring from a Coverdell Education Savings Account?

- Funds in a Coverdell education savings account may also be used for K-12 education expenses.

- Funds in both Coverdell education saving accounts and 529 plans can be withdrawn tax-free for qualified higher education expenses. However, as a 529 plan, a VHEIP account is more flexible because it does not have the more restrictive annual contribution limits, age limits, and income limits of the Coverdell.

- To make a transfer into your existing VHEIP account, complete the Incoming Rollover Form and return it to us.

- If you don’t yet have an account established with VHEIP, open a new VHEIP account. You will still need to complete the form and return it to us, so we can initiate the transfer request with the financial institution holding your funds.

Transferring from an UGMA/UTMA account?

- If you have UGMA/UTMA account, which is technically considered to be owned by the beneficiary, you may still transfer the assets into a VHEIP account. You may not subsequently change beneficiaries on the VHEIP account, however; the assets must remain available for the use of the original beneficiary.

- Transferring UGMA/UTMA assets into VHEIP provides you with 529 plan benefits including tax deferred growth and tax exempt withdrawals for qualified education expenses and favorable treatment in financial aid formulas.

- To make a transfer into your existing VHEIP account, complete the Incoming Rollover Form and return it to us.

- If you don’t yet have a Custodial Account established with VHEIP, open a new VHEIP account as a custodial account (UGMA/UTMA). You will still need to complete the form and return it to us so we can initiate the transfer request with the financial institution holding your UGMA/UTMA funds.

- Transferring assets out of an UGMA/UTMA may result in taxes due. Consult your tax advisor.

Need to initiate an incoming rollover or make another change? See Account Forms.

Federal tax reform info: The Internal Revenue Code includes provisions related to 529 plan accounts. See the Disclosure Booklet for details. In 2022, Vermont tax law was updated to add two new allowable uses of funds withdrawn from a VT529 account without adverse impact on the Vermont income tax credit: (1) for apprenticeship programs registered and certified with the U.S. Secretary of Labor and (2) for repayment of up to $10,000 per the lifetime of a beneficiary in student loans for post-secondary education at an approved postsecondary education institution. (See the VHEIP tax credit information on the VT Tax website.) Vermont tax law currently does not treat a rollover to a Roth IRA or a withdrawal used for K through 12 education expenses as an allowable use. Please consult your tax advisor for how this may affect your personal Vermont tax situation.

-

Claim Your Vermont Income Tax Credit

Participants paying Vermont taxes may be able to claim the Vermont state income tax credit for contributions made to a VHEIP account. Said contributions may only be claimed by a single individual and may not be for a subsequent or future year.

Unsure how much you contributed during a certain tax year? Log in to view your Financial Statements which include a transaction summary at the end of each quarter outlining the tax year for each contribution received during that time period.

- On Schedule IN-119, VT Tax Adjustments and Non-Refundable Credits, enter the amount you contributed to VHEIP during the tax year under Part II, VT Income Tax Credits, line 1, VT Higher Education Investment credit, and calculate the credit per the instructions. Note: FEIN if required for online filers is 030216589.

- Enter your total tax credit amount (VHEIP plus any other Vermont tax credits you receive) on IN-111, Line 19.

- Paper filers may need to copy the annual VHEIP statement and include with forms when filing.

See the Vermont Official State Website for forms. For details and examples, including information on nonqualified withdrawals, see the Vermont Department of Taxes Technical Bulletin (TB-66).

Federal tax reform info: The Internal Revenue Code includes provisions related to 529 plan accounts. See the Disclosure Booklet for details. In 2022, Vermont tax law was updated to add two new allowable uses of funds withdrawn from a VT529 account without adverse impact on the Vermont income tax credit: (1) for apprenticeship programs registered and certified with the U.S. Secretary of Labor and (2) for repayment of up to $10,000 per the lifetime of a beneficiary in student loans for post-secondary education at an approved postsecondary education institution. (See the VHEIP tax credit information on the VT Tax website.) Vermont tax law currently does not treat a rollover to a Roth IRA or a withdrawal used for K through 12 education expenses as an allowable use. Please consult your tax advisor for how this may affect your personal Vermont tax situation.

-

Change Investment Options

Once you invest in any of the six VHEIP investment portfolios, you can transfer those already invested contributions and any earnings to another VHEIP investment portfolio. This change is allowed up to two (2) times per calendar year per beneficiary. However, if you replace the account beneficiary with another qualifying family member at the same time, there is no federal limit on the number of times this change can occur.

You can also change the instructions of how your future contributions are allocated across your selected investment options at any time. There is no limit to the number of times you can do this.

Need to rebalance your account, change the allocation of your future contributions, or make another change? Log in to your account online at any time or see our Account Forms page.

For more about the investment options and performances, see Investment Options & Performance.

-

Change Account Owners and/or Beneficiaries

The account owner of the VHEIP account has all control of the funds. The account owner can change the beneficiary at any time to another member of the previous beneficiary’s family. As the account owner, you can even make yourself the beneficiary. If desired, you can also transfer account ownership to another individual, and/or name a contingent account owner.

Need to change an account owner, change a named beneficiary, or make another change? See Account Forms.

-

Change an Address or Email

To change a mailing address, email, or to make any other administrative change for your accounts: Log in to your account online at any time, contact VHEIP toll-free at 1-800-637-5860, Monday through Friday, 8:00 am – 7:00 pm ET, or see our Account Forms page.

-

Make a Withdrawal

Federal tax reform info: The Internal Revenue Code includes provisions related to 529 plan accounts. See the Disclosure Booklet for details. In 2022, Vermont tax law was updated to add two new allowable uses of funds withdrawn from a VT529 account without adverse impact on the Vermont income tax credit: (1) for apprenticeship programs registered and certified with the U.S. Secretary of Labor and (2) for repayment of up to $10,000 per the lifetime of a beneficiary in student loans for post-secondary education at an approved postsecondary education institution. (See the VHEIP tax credit information on the VT Tax website.) Vermont tax law currently does not treat a rollover to a Roth IRA or a withdrawal used for K through 12 education expenses as an allowable use. Please consult your tax advisor for how this may affect your personal Vermont tax situation.

Important Notice Regarding Withdrawals:

- Withdrawal requests received in good order by close of the NYSE (usually 4 pm ET) will be processed on the business day on which it was received. Withdrawal requests received in good order after the close of the NYSE or on a holiday will be processed on the next business day.

- A withdrawal may be held under any of the following circumstances:

- Your withdrawal includes funds from a contribution made within the last ten (10) days.

- You have made a change to your mailing address within the last fifteen (15) days.

- You are directing a withdrawal to a new bank account or other financial account that was established with the Plan within the last fifteen (15) days.

- The account has been transferred to a new Account Owner within the last fifteen (15) days.

- In all circumstances referenced above, the withdrawal will be processed on the applicable trade date of when it was received, but funds will be held until the hold period has expired before being sent to the requested recipient.

When you request a withdrawal:

- Choose where and how the funds will be sent. You may have the funds sent to:

- You (the account owner) by electronic deposit directly into your bank account. Allow 2 to 3 days for the deposit of funds once the transaction is processed.

- You or your Beneficiary, by check via the mail. Allow 7 to 10 days for receipt of funds once the transaction is processed.

- The eligible educational institution, by check via the mail. Allow 7 to 14 days for receipt of funds once the transaction is processed.

- Worried about your funds getting there in time? Any funds sent by check will be sent via regular mail with the US Postal Service. If you need your funds sooner, you may request that the funds are sent to the account owner by electronic deposit.

- Designate whether the withdrawal is for:

- Qualified higher education expenses. Keep receipts and other documents to substantiate education expenses. You are not required to submit these to make a withdrawal, but should keep them with your tax records.

- Non-qualified withdrawal. The earnings portion of non-qualified withdrawals are subject to federal and Vermont income taxes and an additional 10% federal tax, and you must repay any Vermont state tax credit that was given for the withdrawn portion of the contributions.

Need to request a withdrawal or make another change? Log in to your account online at any time or see our Account Forms page.

-

Sign Up for eDelivery

Go paperless! Choose eDelivery. A $25 annual fee will apply for delivery of official plan documents (your statements, confirmations and/or plan disclosure information) via U.S. mail. This fee will be waived for tax forms. To learn more, please refer to the Disclosure Booklet.

Account owners can avoid this fee by signing up for eDelivery! Simply log in to your account, go to the Profile tab, and update your Delivery Options preferences.

-

Use a VT529 Prepaid Debit Card

The VT529 Prepaid Card, available September 2023, is a reloadable prepaid debit card that is a flexible, convenient, and secure way for an Account Owner or Beneficiary to pay for qualified higher educational expenses using the funds in their VT529 savings account.

The VT529 Prepaid Card is funded by withdrawals the Account Owner initiates from their VT529 savings account. The Prepaid Card is accepted anywhere Mastercard debit cards are accepted.

Why use a VT529 Prepaid Card?

- Flexibility. Use the VT529 Prepaid Card to pay for qualified education expenses easily and instantly at any institution or merchant that accepts Mastercard, including online retailers.

- Convenience. Order your VT529 Prepaid Card, track your transactions, and monitor your card balance from your online VT529 account, without having to create an account on a third-party website.

- Security. The VT529 Prepaid Card comes with advanced security features that protect your account from fraud and unauthorized transactions.

How do I request a card?

- Request a VT529 Prepaid Card anytime by logging in to your account, and selecting “Request a Card” under the “Prepaid Cards” tab.

- After you receive your VT529 Prepaid Card, activate your card by calling the number on the sticker on the front of your card.

- Once activated, your VT529 Prepaid Card can be loaded by logging into your account. Request a withdrawal and select the “VT529 Card” option. Funds will be transferred from your VT529 savings account to your VT529 Prepaid Card and will be available on your card within 3 to 4 business days from the date of the withdrawal.

NOTE: Funds that are transferred to a VT529 Prepaid Card cannot be transferred back into a VT529 account. If you plan to use your VT529 Prepaid Card to pay for tuition or expenses at an institution, be aware of the school’s policy for receiving payments via card transactions. Inquire if any fees are charged when paying via debit card.

Who can request a card?

- The Account Owner can order a card for themselves and/or a card for each qualified beneficiary.

- The Account Owner and Qualified Beneficiary will have separate cards. Each card will have its own separate balance for spending and tracking purposes.

- Beneficiary must be 18 years of age or older to request their own card.

- Check your available balance and transaction history by logging into your VT529 account.

- You will not be able to exceed your available balance. Attempted transactions that would result in exceeding your available balance will be denied.

The VT529 Prepaid Card can be used everywhere Mastercard® debit cards are accepted, online and in stores. To learn more, please refer to the Disclosure Booklet and the VT529 Prepaid Debit Card User Agreement.

Important: To report a lost or stolen card, please call 1-800-637-5860 immediately.

* The Prepaid Card is not a credit card that extends credit, nor does it draw directly from the VT savings account. Card cannot be used for ATM transactions, cash or teller withdrawals at a financial institution or receive cash back from a merchant transaction.

PDF files require the free Adobe Acrobat Reader. Get it here.

What are the requirements for checks?

- Checks should be made payable to the Vermont Higher Education Investment Plan.

- Contributions by check must be drawn on a banking institution located in the United States in U.S. dollars.

- You may contribute to VHEIP using:

- personal checks (excluding starter checks and cashier’s checks), bank drafts, or teller’s checks.

- checks issued by a financial institution or brokerage firm made payable to the account owner or the beneficiary and endorsed over to VHEIP by the account owner.

- a third-party personal check up to $10,000 that is endorsed over to VHEIP.

Contributions by check should be accompanied by a completed Additional Contribution by Mail Form or should include reference the VHEIP account number(s) to which the contribution should be applied.

×What are the minimum and maximum contribution limits?

- $25 minimum for automatic contributions (you choose the frequency schedule—monthly, quarterly, yearly, and more).

- $25 to make one-time contributions by check, electronic funds transfer (EFT), or recurring ACH.

- $15 to contribute per pay period via payroll deduction.

- No limit on contributions per beneficiary account as long as the total balance of all accounts for that beneficiary does not exceed $550,000.

- Accounts may continue to accrue earnings even if they have reached the maximum account balance limit.

What is the Vermont state income tax credit?

As Vermont’s official 529 college savings plan, VHEIP is the only 529 plan that qualifies for a Vermont state income tax credit.

- A state income tax credit of 10% of the first $2,500 contributed to VHEIP per beneficiary per tax year is available to any Vermont taxpayer (or, in the case of a married couple filing jointly, each spouse) – that’s a credit of up to $250 on annual contributions per beneficiary per account owner ($500 per beneficiary for married couples filing jointly).

- Rollovers from another state’s 529 plan into VHEIP are also eligible for the 10% tax credit on the contributions portion of the rollover (not on the earnings). The funds must remain in VHEIP for the remainder of the taxable year in which the funds were rolled in.

Who is considered a family member of a 529 beneficiary?

A qualifying family member includes any siblings or step-siblings, natural or legally adopted children, stepchildren, parents or ancestors of parents, step-parents, first cousins, nieces or nephews, and aunts or uncles. In addition, the spouse of the beneficiary or the spouse of any of those listed above also qualifies as a family member of the beneficiary.

×Qualified higher education expenses include tuition, fees, and the cost of books, supplies, and equipment required for the enrollment and attendance of the beneficiary at an eligible educational institution, and certain room and board expenses. Qualified higher education expenses also include certain additional enrollment and attendant costs of a beneficiary who is a special needs beneficiary in connection with the beneficiary’s enrollment or attendance at an eligible institution. For this purpose, an eligible educational institution generally includes accredited postsecondary educational institutions offering credit toward a bachelor’s degree, an associate’s degree, a graduate-level degree or professional degree, or another recognized postsecondary credential.

×A non-qualified withdrawal is any withdrawal that does not meet the requirements of being: (1) a qualified withdrawal; (2) a taxable withdrawal; or (3) a rollover. The earnings portion of a non-qualified withdrawal may be subject to federal income taxation, and the additional tax. Recapture provisions apply. See the Disclosure Booklet for details.

×Eligible education institutions are accredited, post-secondary educational institutions offering credit towards a bachelor’s degree, an associate’s degree, a graduate level or professional degree, or another recognized post-secondary credential. Use the Federal School Code Search on the Free Application for Federal Student Aid (FAFSA) website or contact your school to determine if it qualifies as an eligible educational institution. 529 Plan assets can also be used at some accredited foreign schools. If you have a question, contact your school to determine if it qualifies.

×The federal tax act of 2017, signed into law in December 2017, includes provisions related to 529 plan accounts, beginning with the 2018 tax year:

- 529 withdrawals may be used to pay for qualified K-12 expenses for elementary or secondary public, private or religious schools effective January 1, 2018. These K-12 withdrawals are limited to $10,000 per student per year and apply to tuition expenses only. Withdrawals up to $10,000 per year per beneficiary for K-12 tuition expenses are not subject to federal tax, but the earnings on those withdrawals over $10,000 would be subject to federal tax.

- The Vermont 529 plan statute is written differently, however, and may impose negative Vermont income tax consequences on withdrawals for K-12 tuition. Therefore, for account owners who took the Vermont income tax credit on contributions to their 529 plan, amounts withdrawn for K-12 tuition expenses may be subject to a 10% recapture penalty on those withdrawals, and Vermont may impose tax on the gain realized with respect to the withdrawals.

VSAC, as administrator of the Vermont 529 plan, will provide information as details about the Vermont income tax effects are clarified. We encourage you to consult a qualified tax advisor or the Vermont Department of Taxes at tax.vermont.gov concerning federal and state tax implications for tax years 2018 and beyond, and to save documentation for how all VT 529 fund withdrawals are used.

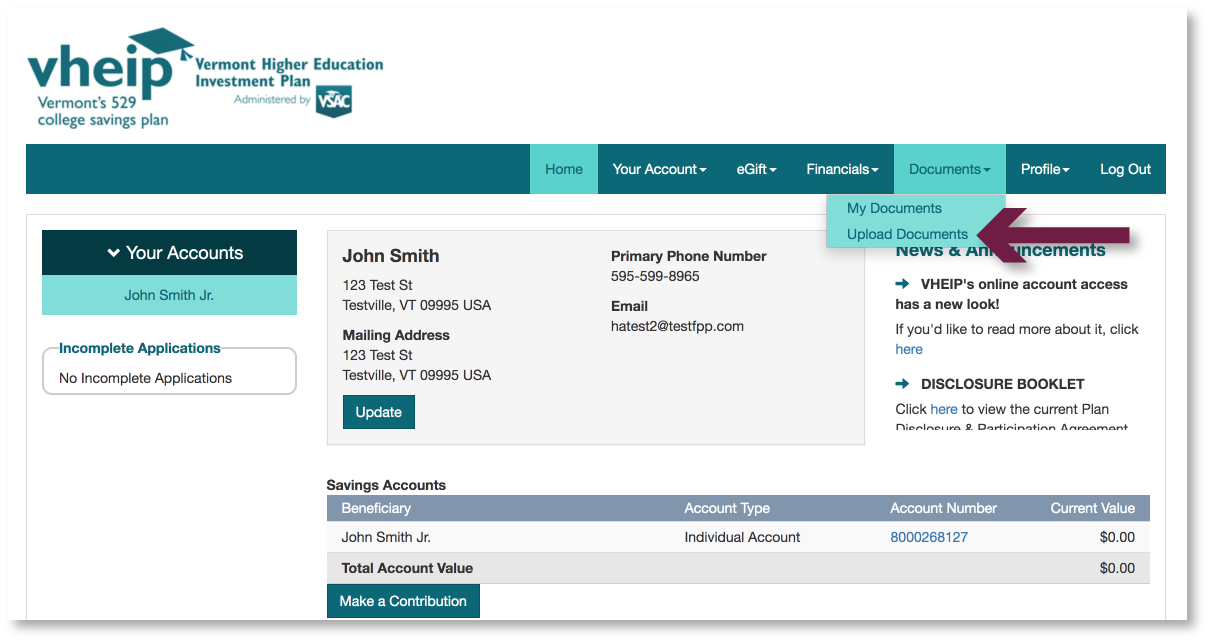

×Need to send us a document? Upload it online!

Simply login to your account and navigate to Upload Documents, located under the Documents tab.