New to VHEIP? Register Now!

Investment Options & Performance

Investment Options

The Vermont Higher Education Investment Plan offers you the choice of six investment portfolios. These options vary in their investment strategy and degree of risk, allowing you to select which portfolio or combination of portfolios is best for your needs.

See the Disclosure Booklet for more information about which investments are appropriate for different types of investors.

-

Managed Allocation Portfolio

(Risk Level Shifts from Aggressive to Conservative)

The Managed Allocation Portfolio seeks to match up the investment objective and level of risk to the investment horizon by taking into account the beneficiary’s current age and the number of years before the beneficiary turns 18 and is expected to enter college. Depending on the beneficiary’s age, allocations to this investment portfolio will be placed in one of six age bands, each of which has a different investment objective and investment strategy. The age bands for younger beneficiaries seek a favorable long-term return by investing primarily in mutual funds that invest primarily in equity securities, each of which has a high level of risk, but greater potential for returns than more conservative investments. As a beneficiary nears college age, the age bands allocate less to mutual funds that invest in equity securities and allocate more to mutual funds that invest in fixed-income and money market securities.

As the beneficiary ages, assets in your account that are attributable to this investment portfolio are moved from one age band to the next promptly following the beneficiary’s birthday at ages 2, 4, 6, 8, 10, 12, 14, 15, 16, 17 and 18.

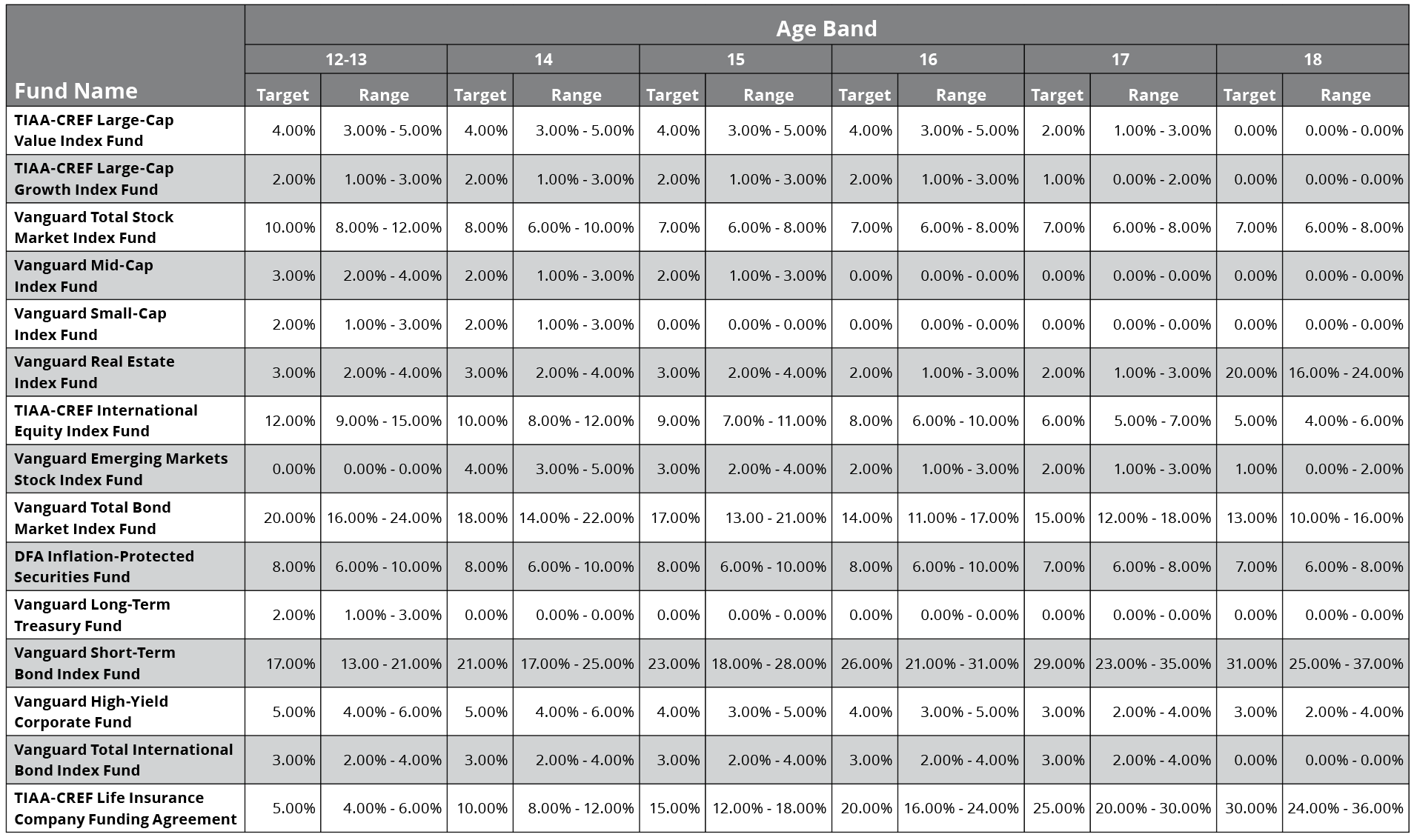

Asset Allocations for the Managed Allocation Portfolio

The following table provides the percentage allocation to each mutual fund within the Managed Allocation Portfolio for each age band.

*The Principal Plus Interest Option replaced the Federated Treasury Obligations Fund as of November 6, 2017. -

Diversified Equity Portfolio

(Risk Level — Aggressive)

The Diversified Equity Portfolio seeks to provide a favorable long-term total return, mainly through capital appreciation and some investment income. This investment portfolio attempts to achieve its objective by allocating assets to mutual funds of various asset classes, including mutual funds that invest in equity securities of larger, well-established companies that offer a growing stream of dividend income, medium-sized and smaller companies, companies engaged in the real estate industry, and companies located outside the United States, including in emerging markets.

Asset Allocations for the Diversified Equity Portfolio

The following table provides the percentage allocation to each mutual fund within the Diversified Equity Portfolio.

TIAA-CREF Large-Cap Value Index Fund TIAA-CREF Large-Cap Growth Index Fund Vanguard Mid-Cap Index Fund Vanguard Small-Cap Index Fund Vanguard REIT Index Fund TIAA-CREF International Equity Index Fund Vanguard Emerging Markets Stock Index Fund 19.0% 20.0% 9.0% 4.0% 8.0% 33.0% 7.0% Range Range Range Range Range Range Range 15.0% – 23.0% 16.0% – 24.0% 7.0% – 11.0% 3.0% – 5.0% 6.0% – 10.0% 26.0% – 40.0% 6.0% – 8.0% -

Equity Index Portfolio

(Risk Level — Aggressive)

The Equity Index Portfolio seeks to provide a favorable long-term total return, mainly from capital appreciation, by investing in equity index funds. This investment portfolio has a high exposure to domestic and foreign equities.

Asset Allocations for the Equity Index Portfolio

The following table provides the percentage allocation to each mutual fund within the Equity Index Portfolio.

Vanguard Total Stock Market Index Fund TIAA-CREF International Equity Index Fund Vanguard Emerging Markets Stock Index Fund 60% 33% 7.0% Range Range Range 48.0% – 72.0% 26.0% – 40.0% 6.0% – 8.0% -

Balanced Portfolio

(Risk Level — Moderate)

This Balanced Portfolio seeks to provide favorable returns that reflect the broad investment performance of the financial markets through capital appreciation and investment income by allocating assets to a balanced combination of equity and fixed-income mutual funds. (At this time, approximately 61% is allocated to equity funds and 39% is allocated to fixed-income funds.)

Asset Allocations for the Balanced Portfolio

The following table provides the percentage allocation to each mutual fund within the Balanced Portfolio.

Vanguard 500 Index Fund Vanguard Mid-Cap Index Fund Vanguard Small-Cap Index Fund Vanguard REIT Index Fund TIAA-CREF International Equity Index Fund Vanguard Emerging Markets Stock Index Fund Vanguard Total Bond Market Index Fund DFA Inflation Protected Securities Portfolio Vanguard Short-Term Bond Index Fund Vanguard High-Yield Corporate Fund Vanguard Total International Bond Index Fund 24.0% 4.0% 3.0% 5.0% 21.0% 4.0% 20.0% 6.0% 5.0% 5.0% 3.0% Range Range Range Range Range Range Range Range Range Range Range 19.0% – 29.0% 3.0% – 5.0% 2.0% – 4.0% 4.0% – 6.0% 17.0% – 25.0% 3.0% – 5.0% 16.0% – 24.0% 5.0% – 7.0% 4.0% – 6.0% 4.0% – 6.0% 2.0% – 4.0% -

Fixed Income Portfolio

(Risk Level — Moderate)

The Fixed Income Portfolio seeks to provide preservation of capital along with a moderate rate of return through a diversified mix of fixed-income mutual funds.

Asset Allocations for the Fixed Income Portfolio

The following table provides the percentage of assets of the Fixed Income Portfolio allocated to each mutual fund.

Vanguard Total Bond Market Index Fund DFA Inflation Protected Securities Portfolio Vanguard Short-Term Bond Index Fund Vanguard High-Yield Corporate Fund Vanguard Total International Bond Index Fund 45.0% 15.0% 15.0% 15.0% 10.0% Range Range Range Range Range 36.0% – 54.0% 12.0% – 18.0% 12.0% – 18.0% 12.0% – 18.0% 8.0% – 12.0% -

Principal Plus Interest Option

The Principal Plus Interest Option seeks to preserve capital and provide a stable return. 100% of the assets of this Portfolio are allocated to a Funding Agreement issued by the TIAA-CREF Life Insurance Company. This Portfolio bears all of the risks of its underlying investment in the Funding Agreement. See Appendix I of the Disclosure Booklet for a summary of the Funding Agreement, including principal investment risks.

-

Performance

IMPORTANT NOTES:-

- The performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an Account Owner’s Units, when redeemed, may be worth more or less than the original cost.

- Performance data for each Investment Option is based on the total return of a hypothetical account, including reinvestment of dividends and distributions, net of the Total Annual Asset Based Fees.

- Returns greater than 1 year are annualized. Performance is based on rolling periods.

- The Managed Allocation Option’s performance reflects changes in asset allocations over time relating to the age of Beneficiaries whose assets are invested in the Managed Allocation Option. Assets invested are automatically transferred to the next Age Band when Beneficiaries reach specified ages up to the Age Band 18+ Years and may not remain invested in the referenced Age Band for a portion of the period reported in the performance chart.

- Effective November 21, 2022, the Age Band Portfolios are new. Performance data and benchmarks for the Portfolios will be on listed here once available.

- Performance prior to November 6, 2017 for the Managed Allocation Option reflects performance attributable to its investment in the Treasury Obligations Fund. Effective November 6, 2017, the assets attributable to the Managed Allocation Option’s investment in the Treasury Obligations Fund were transferred to a Funding Agreement issued by TIAA-CREF Life Insurance Company.

- Past performance-and especially short‑term past performance-information for the Investment Options should not be viewed as an indication of the future performance of any particular Investment Option.

-

Effective October 1, 2023, accumulations under the Funding Agreement for the Principal Plus Interest Option as of September 30, 2023 as well as any contributions received and earnings on those contributions from October 1, 2023 until further notice, will be credited to the Vermont Higher Education Investment Plan with an effective annual interest rate of 3.00% and are guaranteed to earn this rate through September 30, 2024, subject to the claims paying ability of TIAA-CREF Life Insurance Company.

-

-

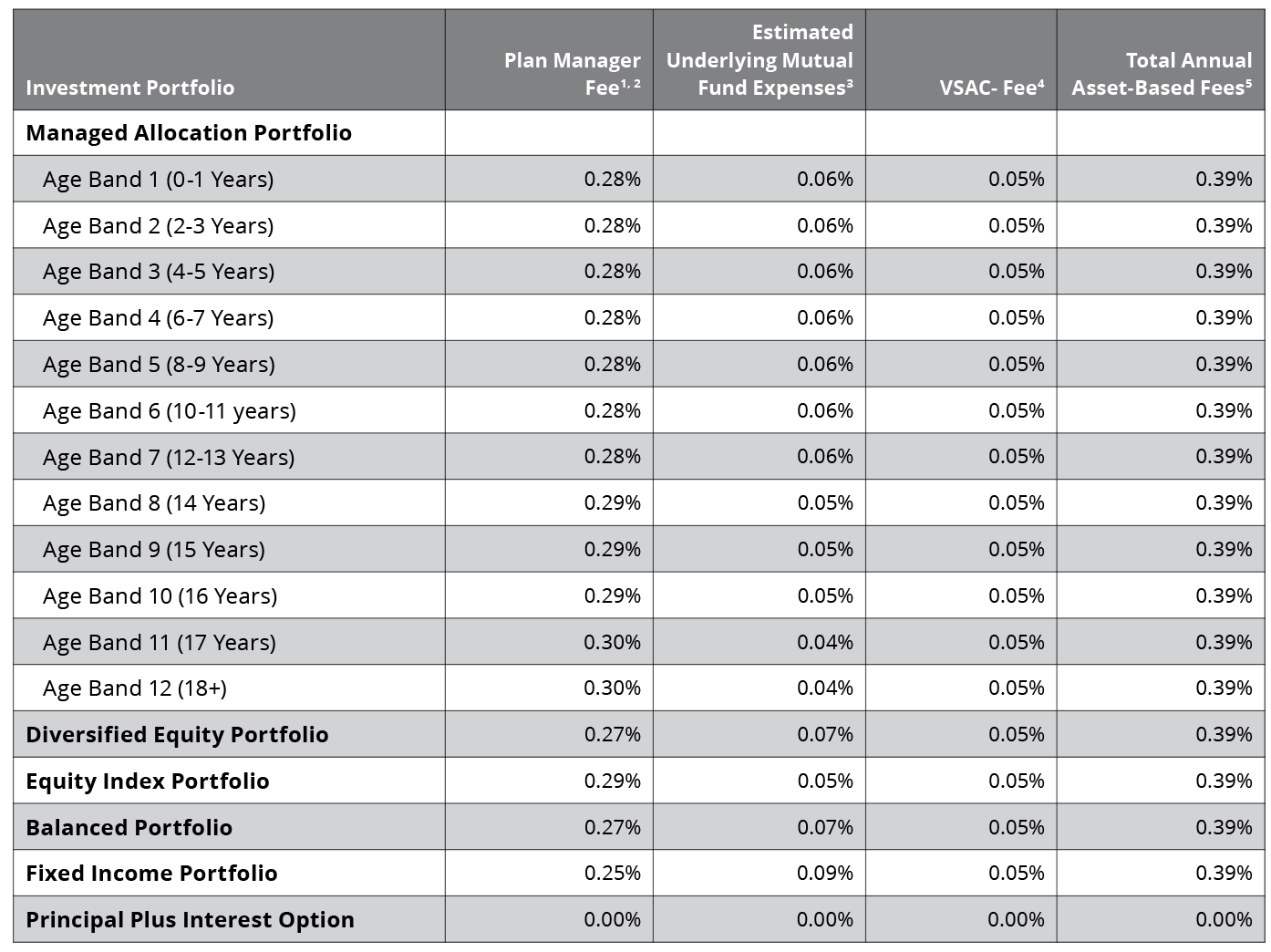

Fees and Expenses

The total annual fees for any option in the plan are 0.39% of the assets. You do not pay these fees separately and no fees are deducted from your account; when you invest in the plan, you indirectly bear a pro rata portion of the plan expenses, because as fees are deducted from plan assets, the value of the plan units is reduced.

- The Plan Manager Fee may change at any time. The plan manager pays the investment manager, the NAV calculation agent, the custodian, and provides funds to VSAC for marketing the Plan from this fee. Although no fees are deducted from your account, when you invest in the Plan, you indirectly bear a pro rata portion of the Plan expenses because when fees are deducted from plan assets, the value of the plan units is reduced.

- Each investment portfolio pays the plan manager an annualized plan manager fee equal to the stated percentage of the average daily net assets held by that investment portfolio.

- For each investment portfolio, the figures in this column are derived from publicly available information for the underlying funds as of July 31, 2015, and are based on a weighted average of the expenses of each underlying fund’s expense ratio, in accordance with the investment portfolio’s asset allocation among its underlying funds. Each investment portfolio indirectly bears its pro rata portion of the underlying funds’ expenses because when fees are deducted from an underlying fund’s assets, the value of the underlying fund’s shares is reduced.

- VSAC receives this fee to offset expenses related to the administration of the Plan.

- The Total Annual Asset-Based Fees (Total Fees) equal the Estimated Underlying Fund Expenses plus the Plan Manager Fee plus the State Fee. The portion of total fees attributable to the Plan Manager Fee is assessed on a daily basis over the course of the year against assets in each investment portfolio. The portion of total fees attributable to Estimated Underlying Fund Expenses is indirectly borne by each investment portfolio as discussed in footnote (3). You should refer to the Investment Cost Example for the total assumed investment cost over 1-, 3-, 5-, and 10-year periods.

- The Principal Plus Interest Option is not charged any fees by the Plan Manager or VSAC and does not incur any underlying mutual fund expenses because it is not invested in a mutual fund.

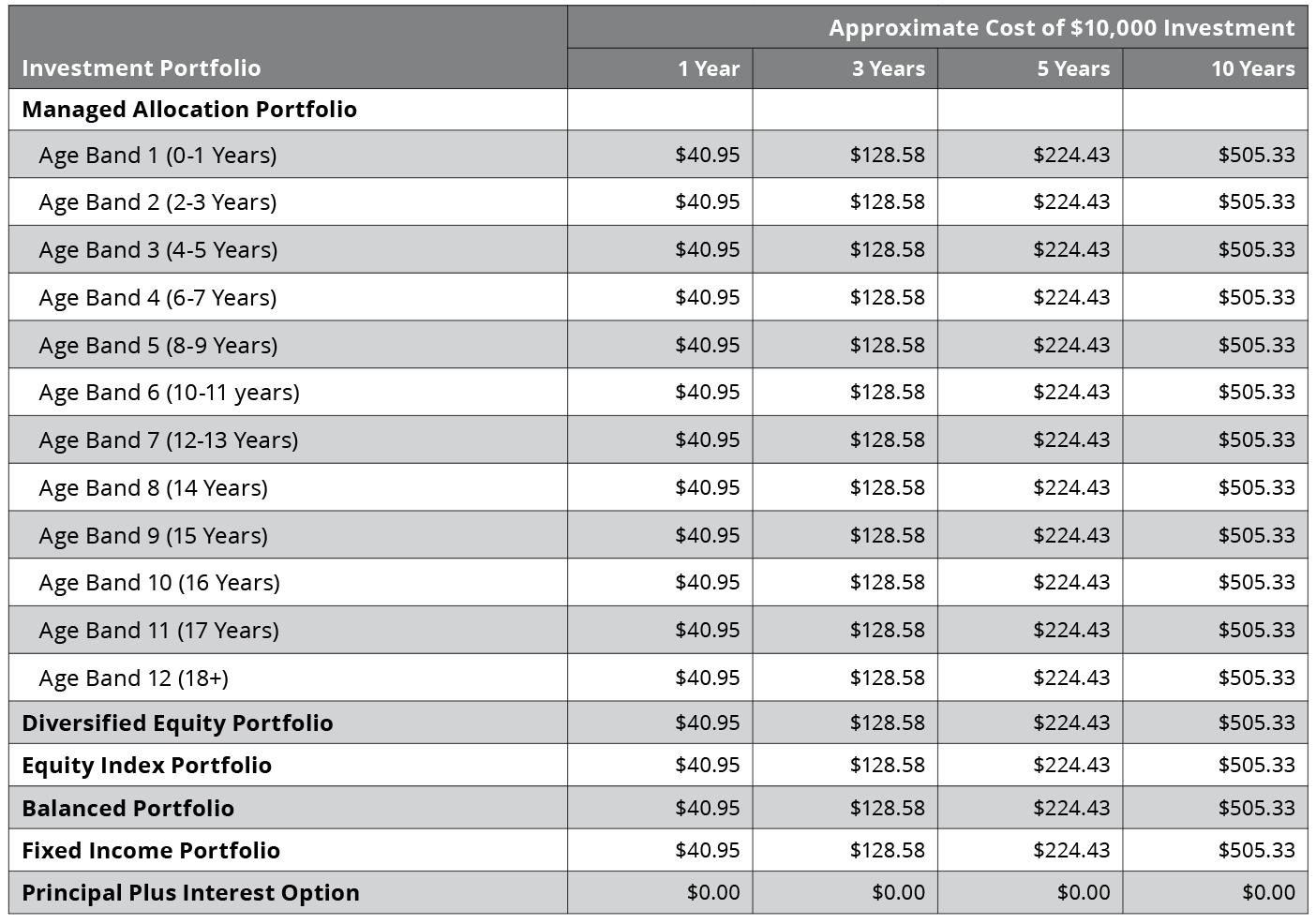

Investment Cost Example

The example in the following table is intended to help you compare the cost of investing in the different investment options over various periods of time. This example assumes that:

- You invest $10,000 in an account for the time periods shown below.

- Your investment has a 5% compounded return each year.

- You withdraw the assets from your account at the end of the specified periods for qualified higher education expense.

- Total annual asset-based fees remain the same as shown in the fee table above.

- The example does not consider the impact of any potential state or federal taxes on the withdrawal.

Your actual costs may be higher or lower. Based on the above assumptions, your costs would be:

Annual Print/Mail Fee for Paper Delivery. The plan manager may charge a $25 annual account print/mail fee to account owners who have not elected to receive official plan documents via electronic delivery. This fee will be deducted as $2.08 per account on or about the 20th day of each month and will be waived if the account’s available balance is less than $25 at the time of assessment. This fee will not be charged for tax documents delivered via U.S. mail.

Account owners can avoid the fee by signing up for electronic delivery of official plan documents. Signing up for electronic delivery is as easy as going to www.vheip.org, logging into your account and selecting electronic delivery in the Profile section. New applicants who enroll via a paper account enrollment form will be given a 30-day grace period from the date their account is created to establish their delivery preferences online prior to incurring this fee.

In the event that an account owner has elected electronic delivery for official plan documents and fails to provide a valid email address, the plan manager will send paper documents to the account owner and charge the $25 annual print/mail fee as applicable.

Fees for Additional Services. The plan manager may debit your account for costs incurred in connection with failed contributions (e.g., returned checks, rejected AIPs, rejected EFTs) or for additional services you request (e.g., overnight delivery, outgoing wires, re-issue of disbursement checks, requests for historical statements, and rollovers).

Reflects current allocations for all investment options. Allocations are reviewed and adjusted periodically.

Account values are not guaranteed and will fluctuate with market conditions. For a complete discussion of risks associate with each investment option, please refer to the Disclosure Booklet.

PDF files require the free Adobe Acrobat Reader. Get it here.

What are the requirements for checks?

- Checks should be made payable to the Vermont Higher Education Investment Plan.

- Contributions by check must be drawn on a banking institution located in the United States in U.S. dollars.

- You may contribute to VHEIP using:

- personal checks (excluding starter checks and cashier’s checks), bank drafts, or teller’s checks.

- checks issued by a financial institution or brokerage firm made payable to the account owner or the beneficiary and endorsed over to VHEIP by the account owner.

- a third-party personal check up to $10,000 that is endorsed over to VHEIP.

Contributions by check should be accompanied by a completed Additional Contribution by Mail Form or should include reference the VHEIP account number(s) to which the contribution should be applied.

×What are the minimum and maximum contribution limits?

- $25 minimum for automatic contributions (you choose the frequency schedule—monthly, quarterly, yearly, and more).

- $25 to make one-time contributions by check, electronic funds transfer (EFT), or recurring ACH.

- $15 to contribute per pay period via payroll deduction.

- No limit on contributions per beneficiary account as long as the total balance of all accounts for that beneficiary does not exceed $550,000.

- Accounts may continue to accrue earnings even if they have reached the maximum account balance limit.

What is the Vermont state income tax credit?

As Vermont’s official 529 college savings plan, VHEIP is the only 529 plan that qualifies for a Vermont state income tax credit.

- A state income tax credit of 10% of the first $2,500 contributed to VHEIP per beneficiary per tax year is available to any Vermont taxpayer (or, in the case of a married couple filing jointly, each spouse) – that’s a credit of up to $250 on annual contributions per beneficiary per account owner ($500 per beneficiary for married couples filing jointly).

- Rollovers from another state’s 529 plan into VHEIP are also eligible for the 10% tax credit on the contributions portion of the rollover (not on the earnings). The funds must remain in VHEIP for the remainder of the taxable year in which the funds were rolled in.

Who is considered a family member of a 529 beneficiary?

A qualifying family member includes any siblings or step-siblings, natural or legally adopted children, stepchildren, parents or ancestors of parents, step-parents, first cousins, nieces or nephews, and aunts or uncles. In addition, the spouse of the beneficiary or the spouse of any of those listed above also qualifies as a family member of the beneficiary.

×Qualified higher education expenses include tuition, fees, and the cost of books, supplies, and equipment required for the enrollment and attendance of the beneficiary at an eligible educational institution, and certain room and board expenses. Qualified higher education expenses also include certain additional enrollment and attendant costs of a beneficiary who is a special needs beneficiary in connection with the beneficiary’s enrollment or attendance at an eligible institution. For this purpose, an eligible educational institution generally includes accredited postsecondary educational institutions offering credit toward a bachelor’s degree, an associate’s degree, a graduate-level degree or professional degree, or another recognized postsecondary credential.

×A non-qualified withdrawal is any withdrawal that does not meet the requirements of being: (1) a qualified withdrawal; (2) a taxable withdrawal; or (3) a rollover. The earnings portion of a non-qualified withdrawal may be subject to federal income taxation, and the additional tax. Recapture provisions apply. See the Disclosure Booklet for details.

×Eligible education institutions are accredited, post-secondary educational institutions offering credit towards a bachelor’s degree, an associate’s degree, a graduate level or professional degree, or another recognized post-secondary credential. Use the Federal School Code Search on the Free Application for Federal Student Aid (FAFSA) website or contact your school to determine if it qualifies as an eligible educational institution. 529 Plan assets can also be used at some accredited foreign schools. If you have a question, contact your school to determine if it qualifies.

×The federal tax act of 2017, signed into law in December 2017, includes provisions related to 529 plan accounts, beginning with the 2018 tax year:

- 529 withdrawals may be used to pay for qualified K-12 expenses for elementary or secondary public, private or religious schools effective January 1, 2018. These K-12 withdrawals are limited to $10,000 per student per year and apply to tuition expenses only. Withdrawals up to $10,000 per year per beneficiary for K-12 tuition expenses are not subject to federal tax, but the earnings on those withdrawals over $10,000 would be subject to federal tax.

- The Vermont 529 plan statute is written differently, however, and may impose negative Vermont income tax consequences on withdrawals for K-12 tuition. Therefore, for account owners who took the Vermont income tax credit on contributions to their 529 plan, amounts withdrawn for K-12 tuition expenses may be subject to a 10% recapture penalty on those withdrawals, and Vermont may impose tax on the gain realized with respect to the withdrawals.

VSAC, as administrator of the Vermont 529 plan, will provide information as details about the Vermont income tax effects are clarified. We encourage you to consult a qualified tax advisor or the Vermont Department of Taxes at tax.vermont.gov concerning federal and state tax implications for tax years 2018 and beyond, and to save documentation for how all VT 529 fund withdrawals are used.

×Need to send us a document? Upload it online!

Simply login to your account and navigate to Upload Documents, located under the Documents tab.